Payroll Forms

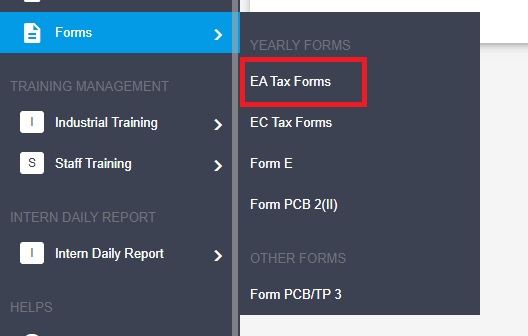

The payroll forms are categorized into two categories: Yearly Forms and Other Forms.

Yearly Forms

Yearly Forms are the forms that contain yearly information for an employee.

EA Tax Forms

EA Tax Forms is a form that need to be prepared and provided to the employee for income tax purpose.

To view the EA Tax Forms, go to the EA Tax Forms.

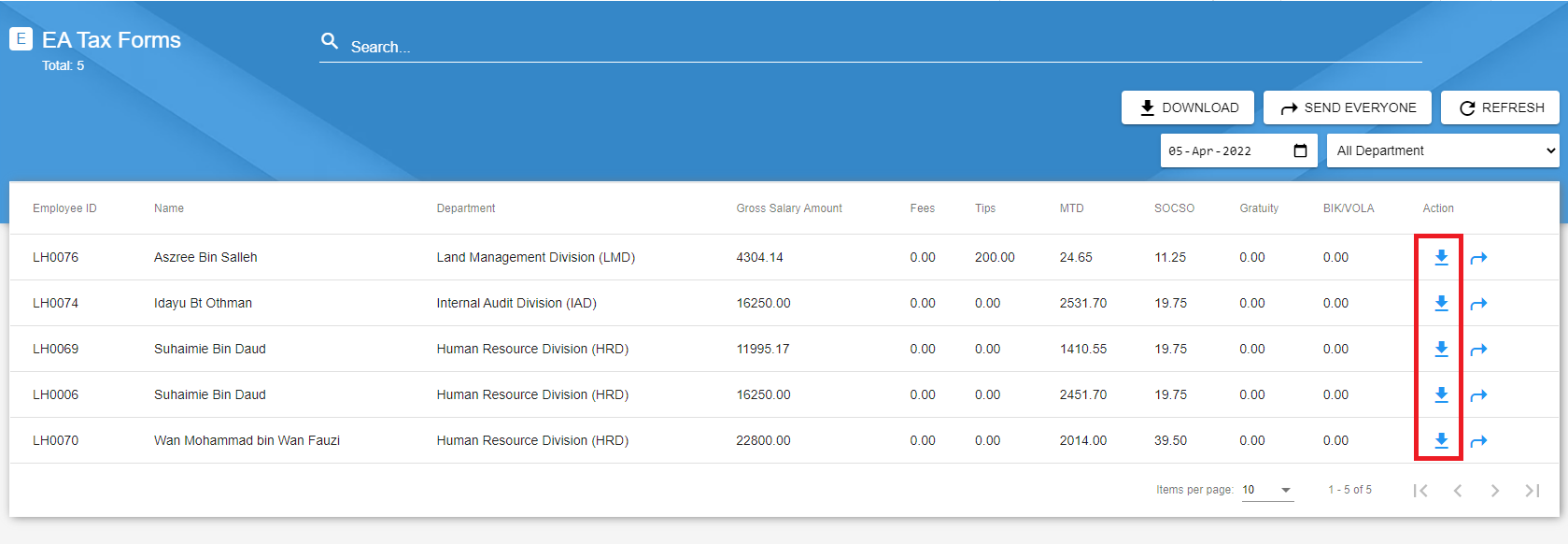

All employee who has the processed payrolls will be listed their name in the Manager with all processed payrolls data.

Download for an employee

To download an EA Tax form for a particular employee, select the

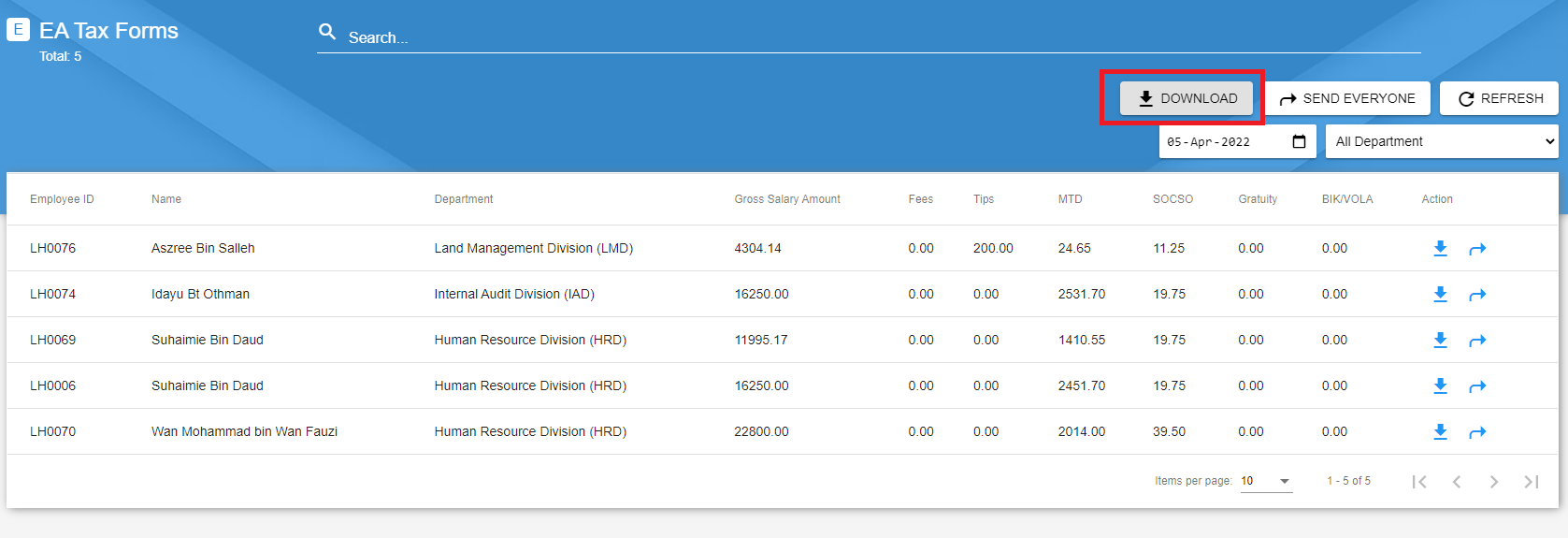

Download for all employees

If you wish to download all employee's EA Tax forms (in PDF/Excel format), click on the Download button on top. The system will zip all the files and download them.

Email to an employee

To directly email the form to the employee's email address, click on the

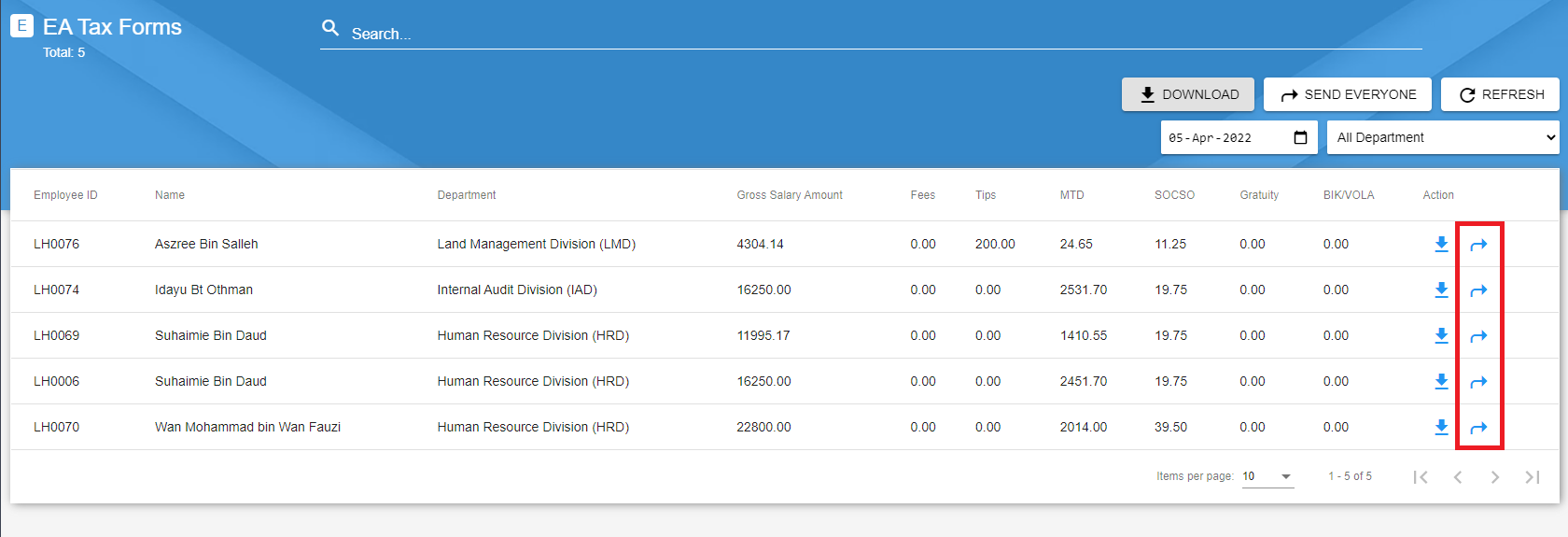

Email to all employees

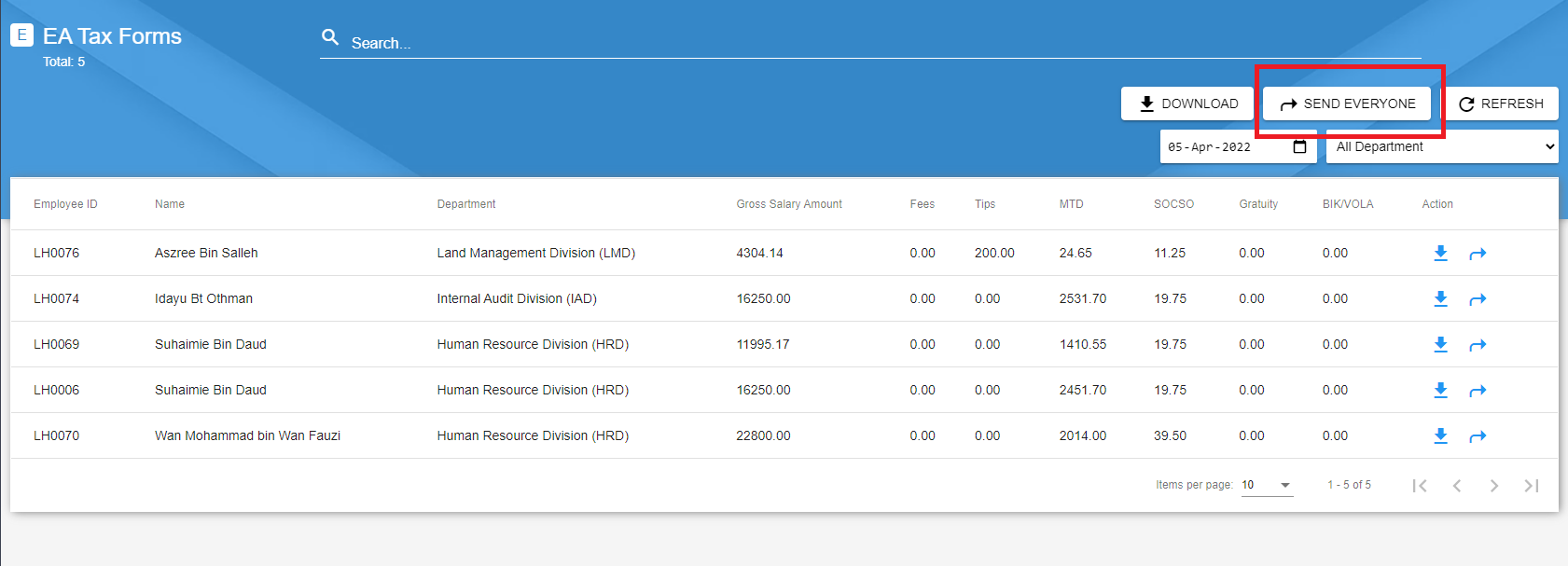

You can email to all employees their EA Tax form by clicking the Send Everyone button. This process may take some time to complete depending on the number of employees.

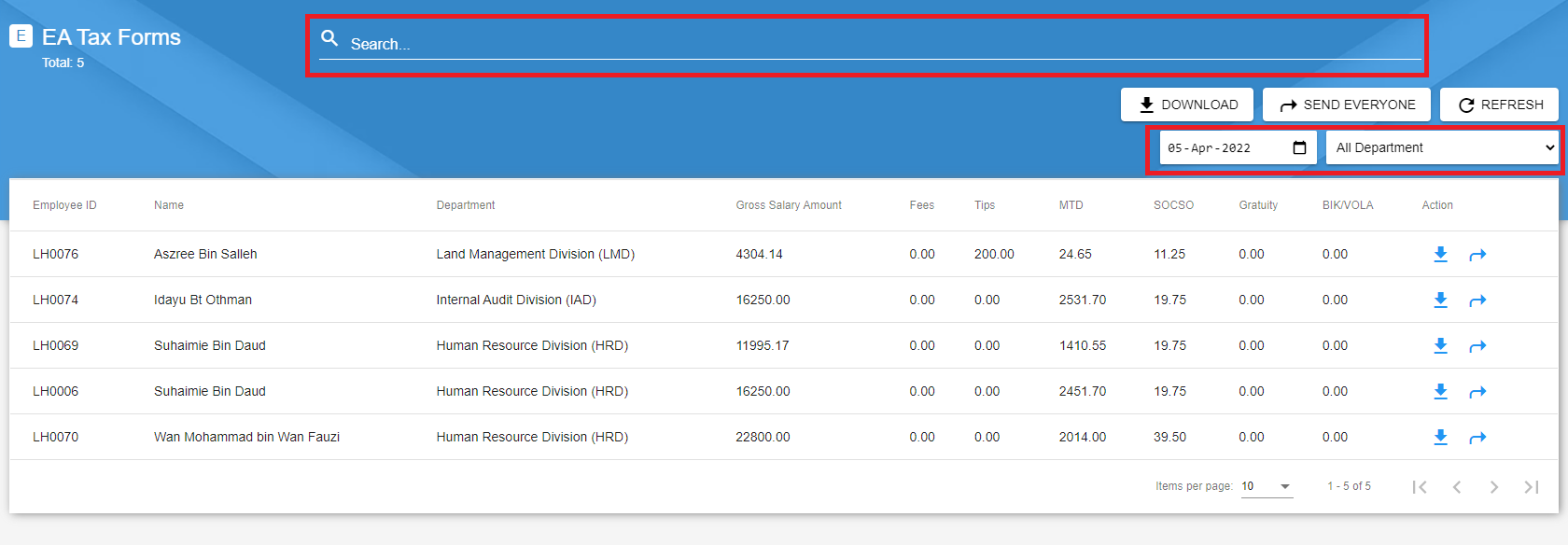

Filter and Search

Use the filter and search bar function to filter the data.

{warning} The

filterandsearch barwill affect thedownloadandsend emailfunctions.

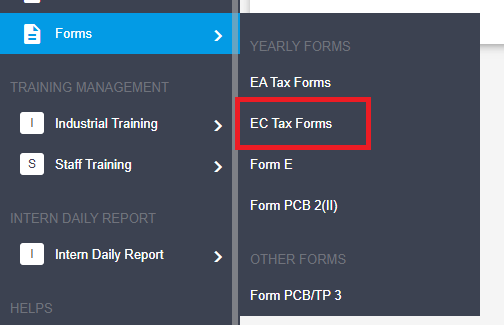

EC Tax Forms

The EC Tax Form contains information on the personal details of the employee and his or her payroll details for the year.

To view the EC Tax Forms, go to the EC Tax Forms.

All employee who has the processed payrolls will be listed their name in the Manager with all processed payrolls data.

The tutorial for each functions that is available in EC Tax Forms are similar to EA Tax Forms. Kindly refers to the section if needed.

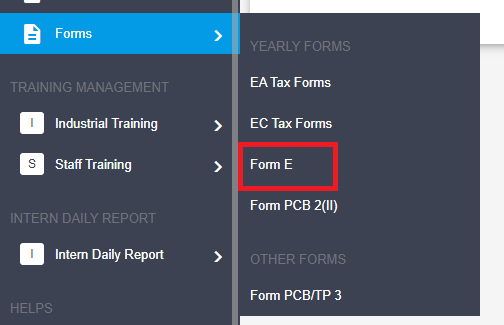

Form E

Form E is a declaration report submitted by every employer to inform the IRB on the number of employees and the list of employee's income details every year.

To view the Form E, go to the Form E.

All employee who has the processed payrolls will be listed their name in the Manager with all processed payrolls data.

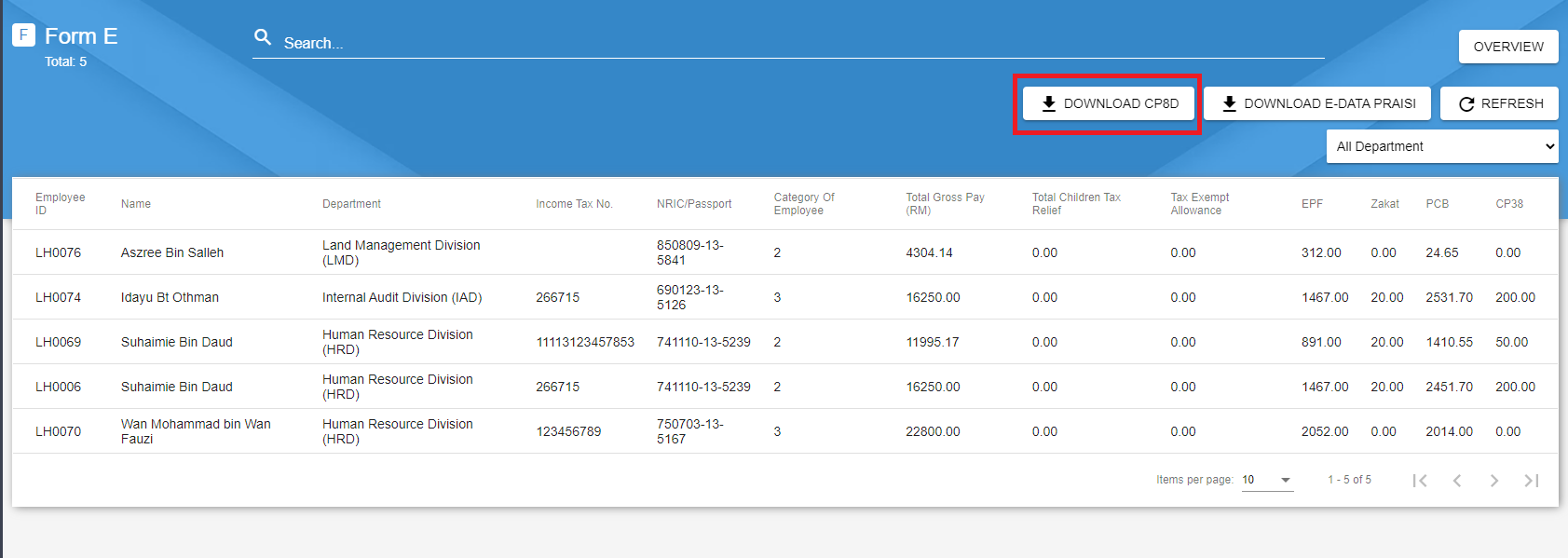

Download CP8D

Click on the Download CP8D and select the format (Excel/TXT).

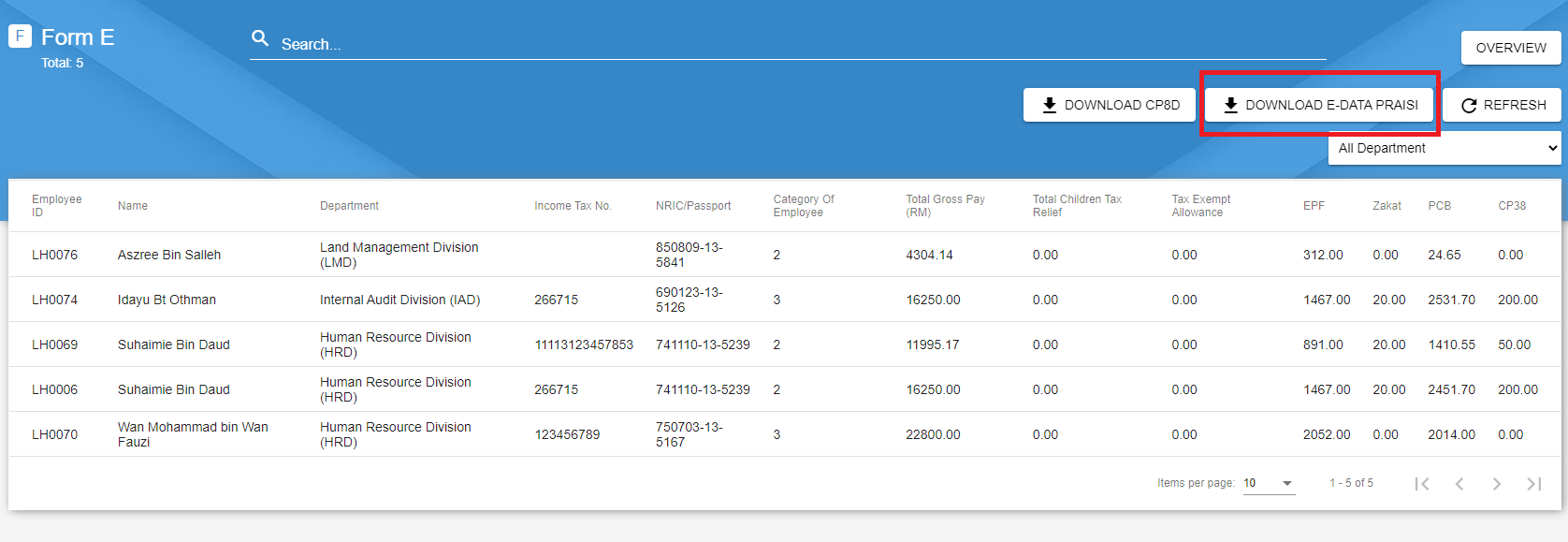

Download E-Data Praisi

Click on the Download E-Data Praisi and select the format (TXT).

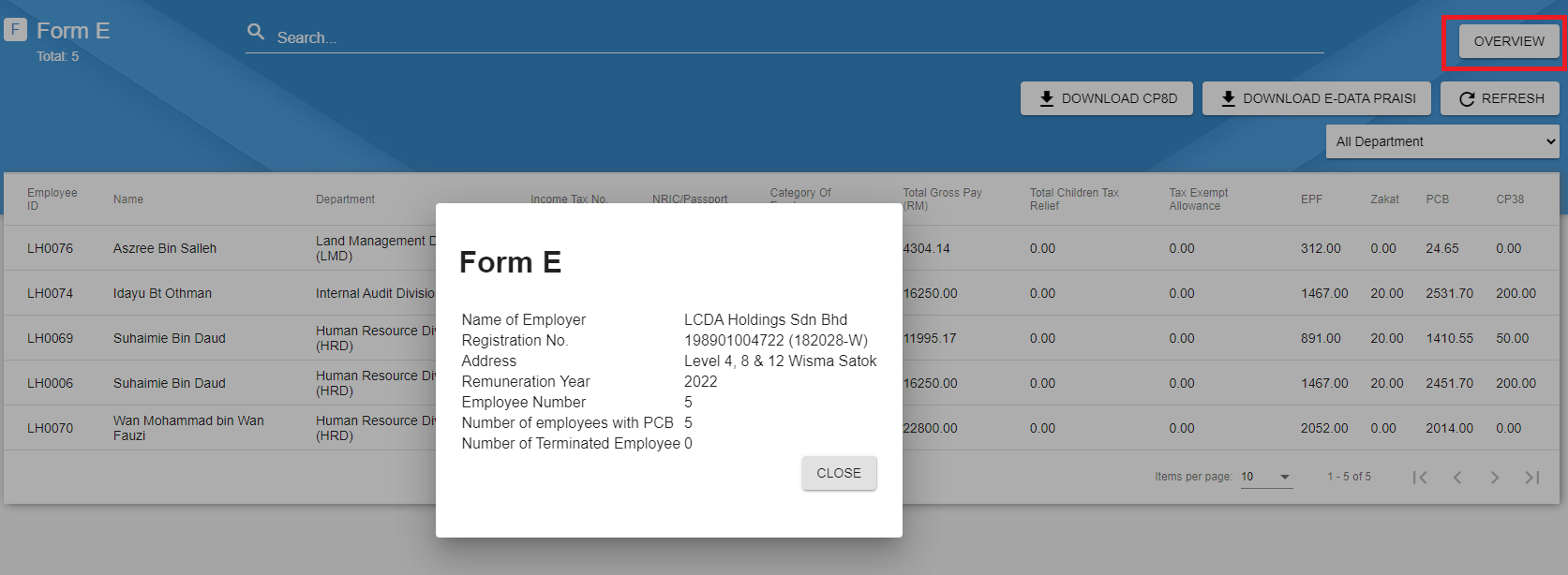

Overview

You can view the overview of a company by clicking on the Overview button at the top right corner.

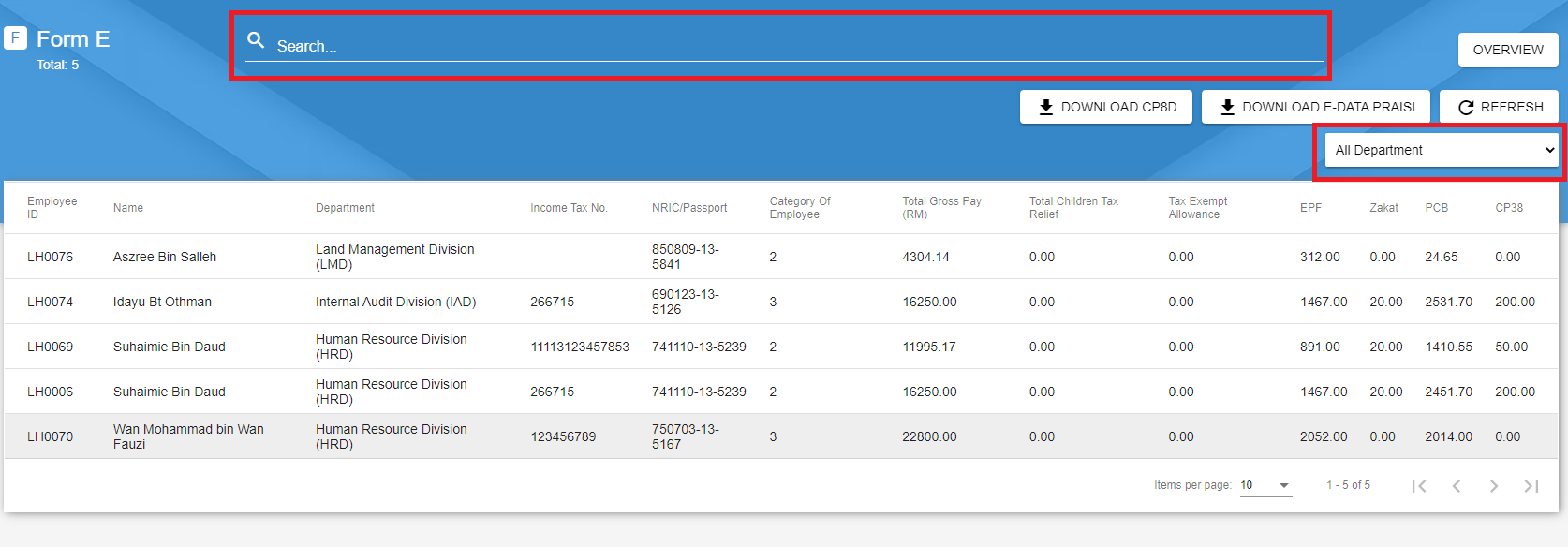

Filter and Search

Use the Filter and Search Bar functions to filtering the data.

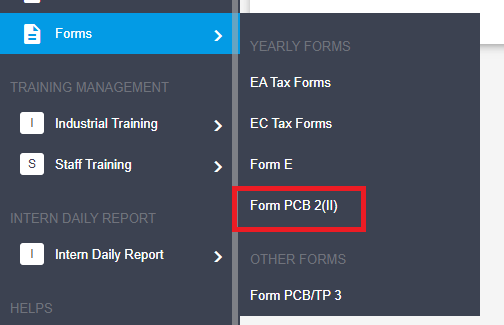

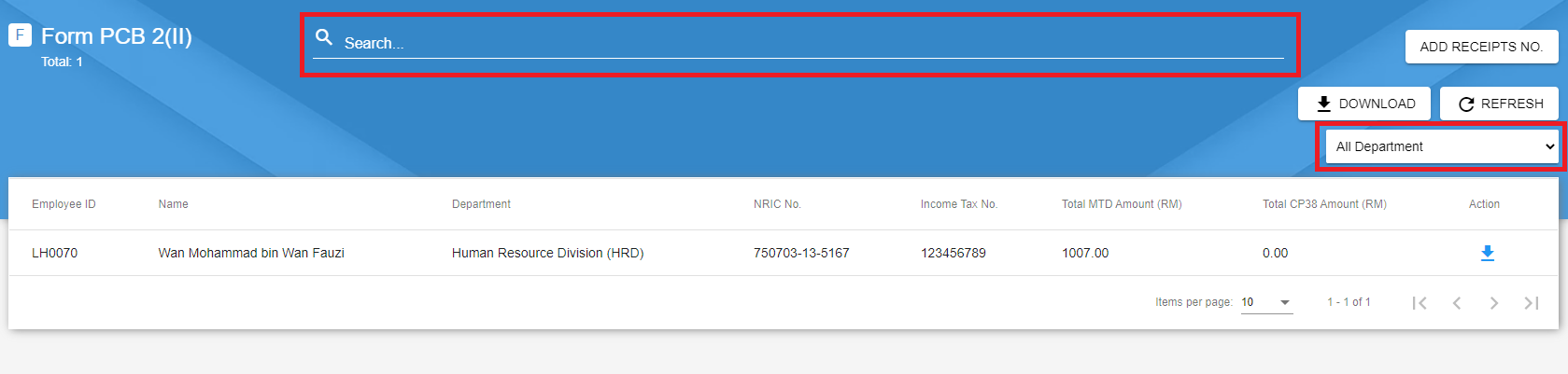

Form PCB 2(II)

Form PCB 2 is a statement that the employer has made all of the tax withholdings for a given period. This form is given to the employee who submits it to the IRB.

To view the Form PCB 2 (II), go to the Form PCB 2(II).

All employee who has tax will be listed their name in the Manager.

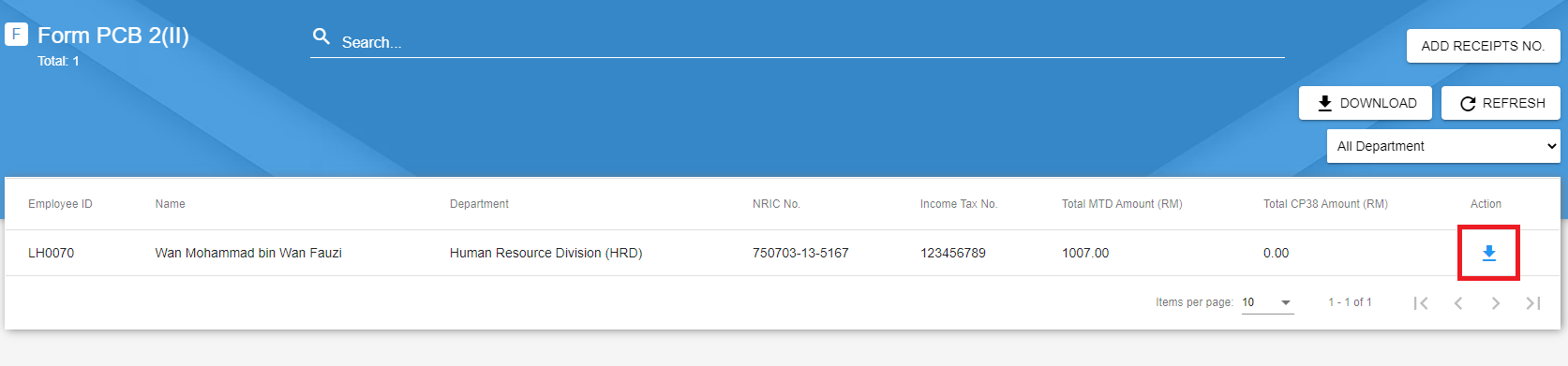

Download for an employee

Click on the

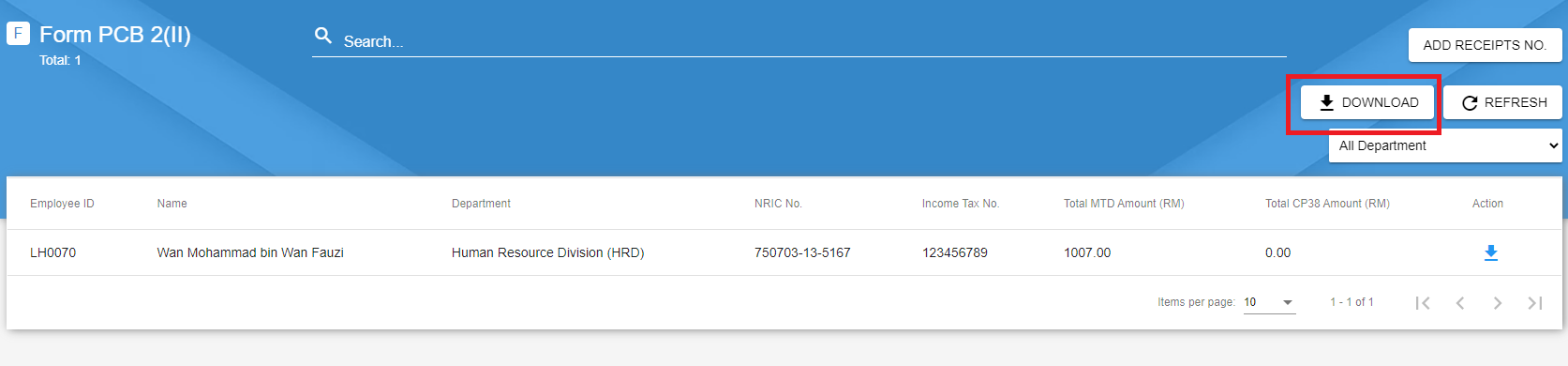

Download for all employees

Click on the Download button on top to download the form for all employees.

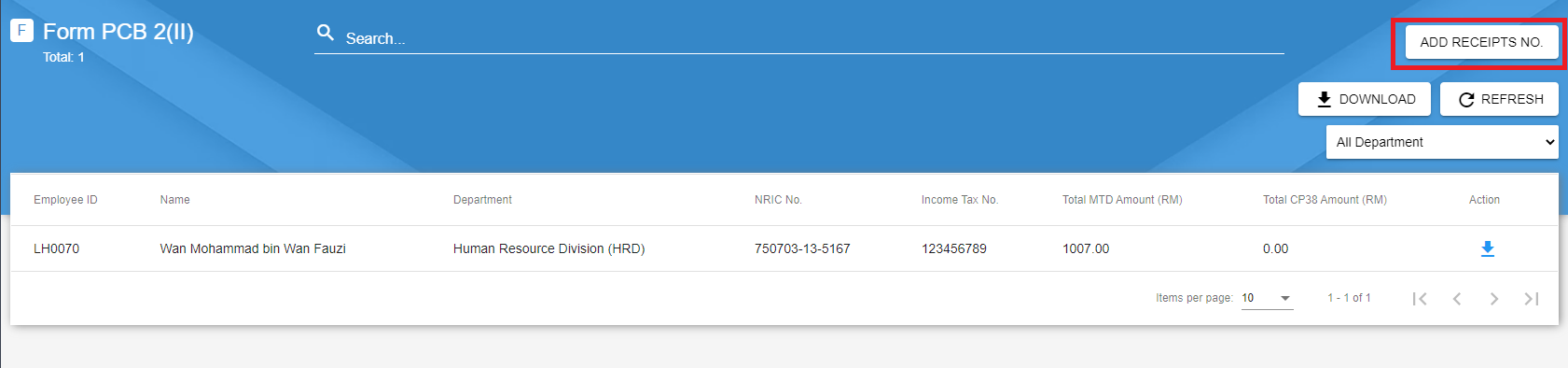

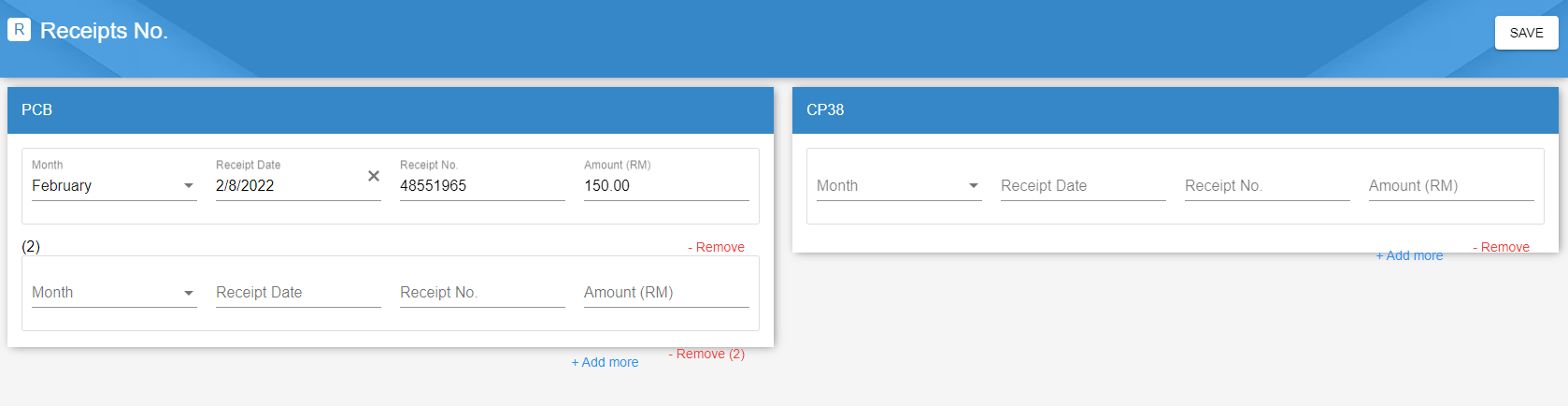

Add Receipts No.

To add a receipt no., click on the Add Receipts No..

You can add the whole year receipts no. here by using the addmore function.

Search and Filter function

Use the filter and search bar to filter the data.

{warning} The

filterwill affect thedownloadfunction.

Other Forms

Form PCB/TP 3

TP 3 form is given to an employer containing information related to their new hired employee's previous employment in the current year. TP 3 contains information regarding the employee's accumulated deductions while working for the past employer.

{info} Only the employee who need to pay tax and joined the company in the selected year data will be displayed.

The tutorial for each functions that is available in Form PCB/TP 3 are similar to EA Tax Forms. Kindly refers to the section if needed.

References: